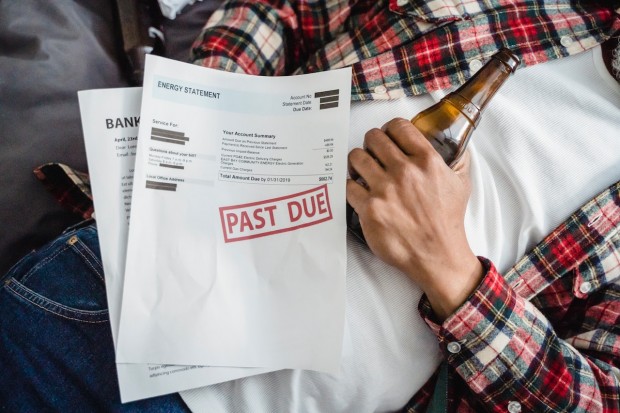

A short-term loan for businesses, often known as a business cash advance, is utilized to meet their immediate financial demands. A small business typically needs only a small quantity of personal and business financial data to apply and receive a preapproval in a couple of hours. The money can then be placed into your company's account within days, if not the same day, and a small business payday loan can be funded extremely rapidly.

How do Cash Advances work?

Since no lending occurs, a business payday cash advance is not really a loan in the conventional sense. Instead, when a business receives a payday cash advance, it is selling part of its future sales to a merchant cash advance company, which agrees to buy those revenues in return for an upfront payment that is made immediately into the selling business's bank account. Payday LV loans may call for either the sale of the business's future bank account entries or the sale of a portion of the volume of transactions the business does using its credit cards.

How do Cash Advances and Payday Loans differ from one another?

A payday loan is a legitimate loan even though it allows a person to acquire fast cash. When we use the term "genuine loan," we mean that funds are being lent from a lender to a borrower and that the loan's conditions have been predetermined. An interest rate is applied to a loan and is often calculated using an APR. Since a cash advance is truly a business-to-business transaction rather than a loan, it is not subject to the same regulations as regular loans.

What purposes do Payday Loans serve?

Payday loans are typically used for working capital purposes. Assuming you do not already have exposure to a line of credit or even company credit cards, a payday loan is a respectable alternative for a firm that requires quick finance to assist bridge liabilities. If necessary, payday loans for businesses are also used to assist with payroll. It may be scary to consider being late with payroll. A business owner may feel more at ease knowing that money is available if they are aware of their ability to acquire a quick business payroll advance. A business could occasionally discover that they need to replace a piece of machinery right away. What would you do if a restaurant's essential oven or stove broke on you and you needed to finance needed equipment right away? To replace the equipment, that eatery can acquire a payroll cash advance in a day or two. These are just a few examples of what a business might do with business payday funding.

What conditions apply to Business Payday Loans?

The conditions for payday loans vary depending on which of the many MCA pl near me lenders you visit. Each payday LV lender for businesses has various standards as well as different lending options. Some companies provide payday loans that necessitate factoring in credit card sales. Some payday lenders demand that a specific percentage of the small businesses' bank deposits be factored in. Other lenders will divide the funds between the two, collecting payback through a mix of credit card purchases and Automated Clearing House (ACH) payments.

What advantages do Business Payday Loans offer?

The advantages of a company payday loan rely on its applications. Even though a payday TX loan could be pricey for the business, it may be quite beneficial if acquiring rapid cash helps with an urgent requirement. Such short-term financing loans could mean the difference between a small business, retail store, restaurant, machine shop, or any other kind of organization being able to continue operating and having to close for a while, which could devastate a business.

What are the Disadvantages?

A payday loan's main disadvantage is that it can often be expensive. Usually, 1.1 to 1.5 times the amount borrowed is required as repayment. The merchant cash advance financier may also charge the borrower extra fees in addition to these factor rates. Furthermore, the repayment terms for these advances range from 4 to 18 months, with many urgent financing companies offering repayment terms of 6 months or less. It cannot be easy on a company's financial flow to repay a loan so soon. The fact that payments are made every day is another factor that is putting stress on cash flow (although there are some funding companies will accept weekly payments).

How does a Business Payday Loan work?

• The Application Process

To be considered for a payday business loan, a company must submit a signed credit application. This allows the lender to examine both business and personal reputation, as well as the small business's tax liens and past advances that the borrower is still repaying. For the MCA lender to examine cash flow and determine how much a borrower can obtain and repay comfortably without throwing the business at risk, the applicant must also provide six months' worth of bank records.

• The Funding Procedure

The funder will give the applicant documents outlining the terms of financing and a list of requirements to be met before the advance business will finish funding once the applicant has been preapproved and has decided how much cash they are going to accept. Among other things, the list of requirements may ask for business tax returns, a business license, a site inspection, AR reports, old bank statements, and payment letters from other funders.

• The Documents Process

A driver's license, a canceled check, completed contracts, and frequently a COJ (confession of judgments) are all essential documents. The MCA or ACH lender frequently requires Confessions of Judgements to be overnighted to them before they can finish funding.

Conclusion

Now that you have read our guide on business quick loans online payday loans, we hope you know that you do not have to jeopardize the financial stability of your company to get quick, simple capital. Business payday loans, also known as merchant cash advances, are a great option for quick money today.

© Copyright 2020 Mobile & Apps, All rights reserved. Do not reproduce without permission.* This is a contributed article and this content does not necessarily represent the views of mobilenapps.com

more stories from How To

-

iPhone Hack: How to Check Microphone-Enabled Apps And How to Turn Off Their Access for Privacy

Explore the nuanced landscape of iPhone microphone privacy, from recent breaches to proactive user strategies.

ernest hamilton -

How to Safely Reset Your Android Phone Before Selling or Passing It On

Learn how to safely factory reset your Android phone with this comprehensive guide. Protect your privacy before selling or passing on your device. Follow this step-by-step instructions for a seamless transition.

ernest hamilton -

How to Fix iPhone Boot Loop: Unlock Your iPhone's Potential with This Step-by-Step Guide

Learn how to conquer the iPhone boot loop with this comprehensive step-by-step guide. Follow the expert instructions to restore your device's functionality and bid farewell to endless reboots

ernest hamilton -

12 Ideas to Crafting a Memorable Mother’s Day Post on Your Business’ Social Media

Discover innovative post ideas and expert tips to engage your audience and drive sales. Read now and make this Mother's Day unforgettable!

ernest hamilton -

‘Coin Master’ Guide: How to Find Chests to Get More Card Collections, XP and Coins

Learn the secrets to unlocking Coin Master chests and supercharge your gameplay! This comprehensive guide reveals expert strategies for acquiring coveted chests, maximizing rewards, and dominating the game.

ernest hamilton -

Roblox: WS10'S MM2 Codes (May 2024)

Unlock rewards with WS10'S MM2 codes for May 2024 in Roblox! Get ahead in the game with exclusive bonuses.

ernest hamilton -

Idle Office Tycoon May 2024 Codes: Get Free Diamonds & More!

Unlock free diamonds and more in Idle Office Tycoon with the May 2024 codes! Redeem them now for exclusive rewards.

ernest hamilton -

Finding GBA ROMs for Your Delta Emulator: A Handy Guide

Looking for GBA ROMs for your Delta Emulator? Check out this handy guide to find and download your favorite games hassle-free!

ernest hamilton